202204051048 Value reciprocity in the insurance industry

This is a social ecosystem structured around reciprocity of value. The way that people earn social connections and trust as good actors in this ecosystem is by providing value to their connections. This is the whole ball game.1

Reciprocity in market-based societies

David Graeber argues that balanced gift exchange and market exchange have more in common than normally assumed. Since both are balanced, the social relationship created through the sense of debt and obligation is constantly in danger of being ended by the return gift/exchange. He thinks it better to contrast "open" and "closed" reciprocity. Open reciprocity "keeps no accounts because it implies a relation of permanent mutual commitment." This open reciprocity is closed off precisely when it is balanced. Thought of in this way, we can see the relationship as a matter of degree, more or less open or closed. Closed reciprocity of gifts is most like market exchange. It is competitive, individualistic and may border on barter.2

Comes down on the substantivist side of the formalist-substantivist debate arguing for a study of how humans make a living in a social and natural environment.

Neo-substantivists examine the ways in which so-called pure market exchange in market societies fails to fit market ideology.

Gift or generalized reciprocity is the exchange of goods and services without keeping track of their exact value, but often with the expectation that their value will balance out over time. Balanced or Symmetrical reciprocity occurs when someone gives to someone else, expecting a fair and tangible return - at a specified amount, time, and place. Market or Negative reciprocity is the exchange of goods and services whereby each party intends to profit from the exchange, often at the expense of the other. Gift economies, or generalized reciprocity, occur within closely knit kin groups, and the more distant the exchange partner, the more imbalanced or negative the exchange becomes.

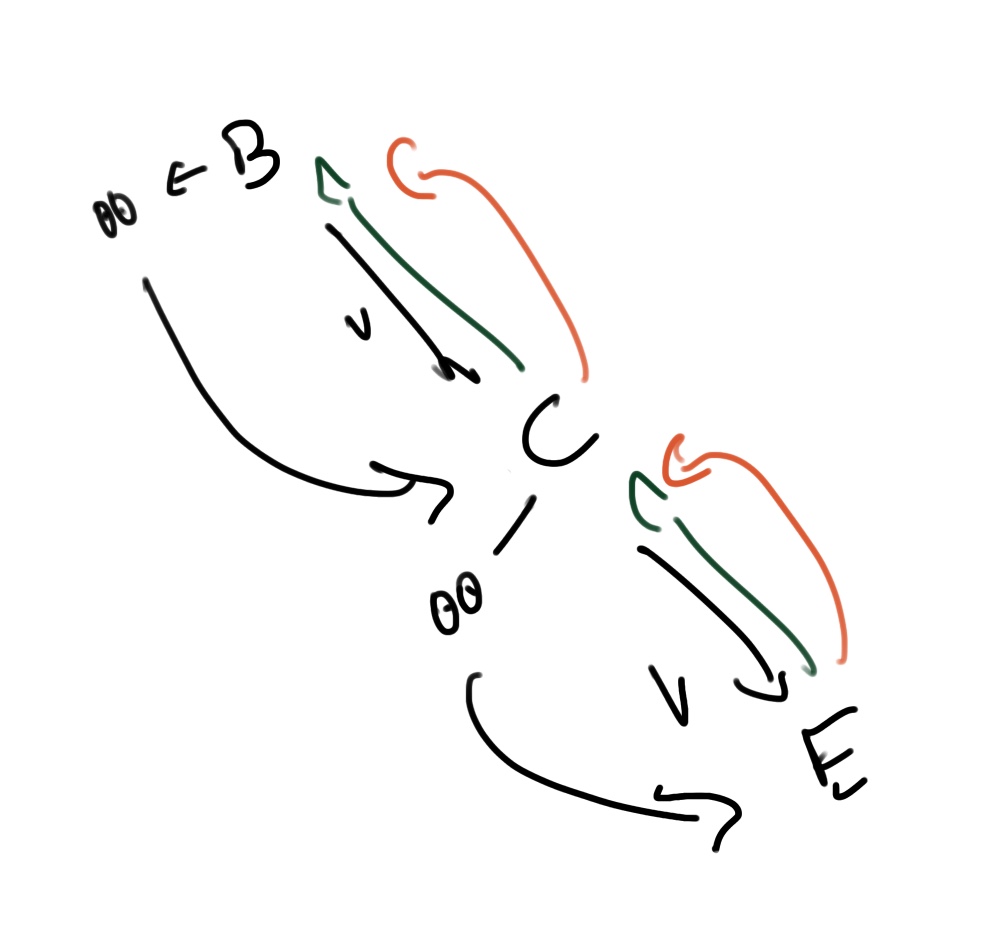

This model aligns with observed behaviors of brokers as a point of flow disruption through negative feed forward. If the group isn’t happy then the value doesn’t flow back to the broker and they’re further disincentivized through energy expenditure costs of repairing trust/non-market cooperation vs the lower cost of gaining new business. A broker’s response in a situation like this is up to them and can stop the flows because a valid option is to pursue different carriers that keep the value flow for members/employers going.

Members have little leverage in this ecosystem because of the cost and scarcity of finding new employment opportunities. They can’t really decide what their employers offer them, even in great companies that allow employee input on the subject the influence is often indirect.

Employers have some good leverage but are missing the information or time/effort requirements to wield it perfectly. The complexity of insurance and the difficulty of shopping around is why brokers exist at all. Brokers obviously possess high leverage by fact of their existence.

#thread see also embededness. Should probably clean this note up a bit and split out the insurance industry’s use of the generalized concepts.

#thread make a flow/story from each starting point and perspective to find stocks and flows, validate model, and find breakdown/forces/levers in the system.

#thread follow up with some good sociological data on modern worker-employer and B2B relationships.

-

Wikipedia contributors. (2021, May 18). Reciprocity (cultural anthropology). In Wikipedia, The Free Encyclopedia. Retrieved 19:06, April 4, 2022, from https://en.wikipedia.org/w/index.php?title=Reciprocity_(cultural_anthropology)&oldid=1023800794 ↩

-

Graeber, David (2001). Toward an Anthropological Theory of Value: The false coin of our own dreams. New York: Palgrave. pp. 219–20. ↩